Start now

Retirement might not be top of mind for all of your employees, but many are likely concerned about their finances and saving for the future. But wanting to put money away for retirement and other major life events is easier said than done.

When employees are stressed about their financial health, performance and productivity often go down. Your job is to find ways to support your people and their financial needs throughout their career.

Financial ownership for them

When your people are stressed about life, they have trouble focusing on work. You can lighten the load by taking the uncertainty out of their financial future.

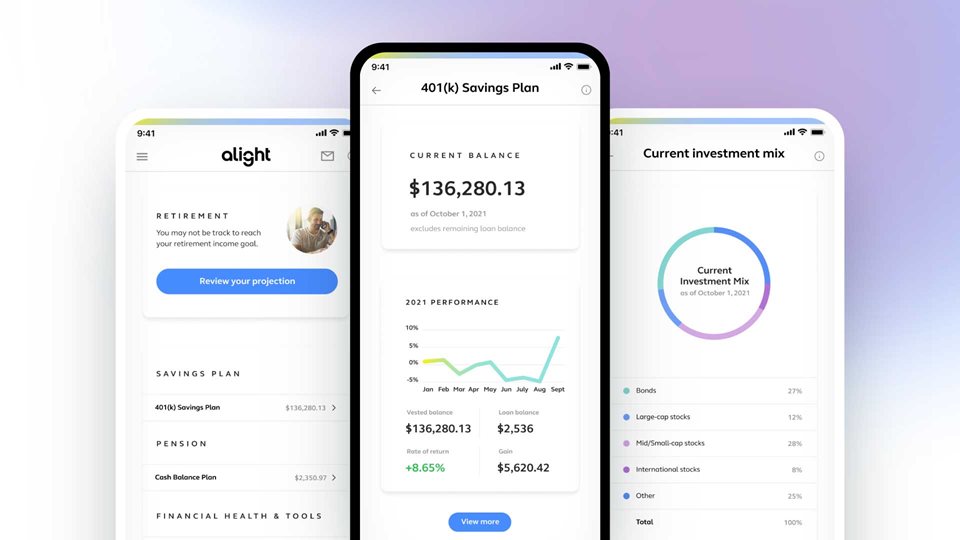

Make sure they know their retirement benefits go beyond just retirement. Encourage saving throughout their career and help them figure out how buying a home, paying for education and saving for the future are all possible.

Financial insights for you

Your employees’ finances have a huge impact on their overall performance and wellbeing. When you have insights on the financial health of your people, you can make sure they’re on the right track. If they’re not, get them there by providing expert advice and guidance services through a trustworthy, independent retirement benefits partner.

Make your employee benefits strategy stronger

We integrate retirement benefits with your broader benefits initiatives to get the most out of your solution.

Ready to learn more about our solutions?

Learn more about how we can help your business.

Explore our Retirement Benefit solutions

Defined Contribution

Guide your people to better financial outcomes and get help managing your plan.

Defined Benefit

Pension planning and administration made easy for you and your people.

Financial Wellbeing

Knowledge, tools and advisory support to help people meet their financial goals.