Plan now, relax later

Financial security is about more than just retirement savings — it impacts your people’s entire wellbeing and career. We make sure your defined contribution plan sets the course for a secure financial future with support every step of the way.

Here’s the Challenge

401(k) plans are complicated

Here’s how we solve it

Make it feel simple

See more of what’s possible with our retirement benefits

For employers

The insights we’ve gained from 40 years of experience have made us the largest independent defined contribution recordkeeper in the U.S. We use our expertise to support the long-term financial health of your people and set your organization up for success.

Benefits

- Open architecture platform supports a full range of investment options

- Industry-leading thought leadership and trend reporting

- Deep experience in non-qualified and qualified plan design and strategy

- Data security for your human capital

Extra help is always available

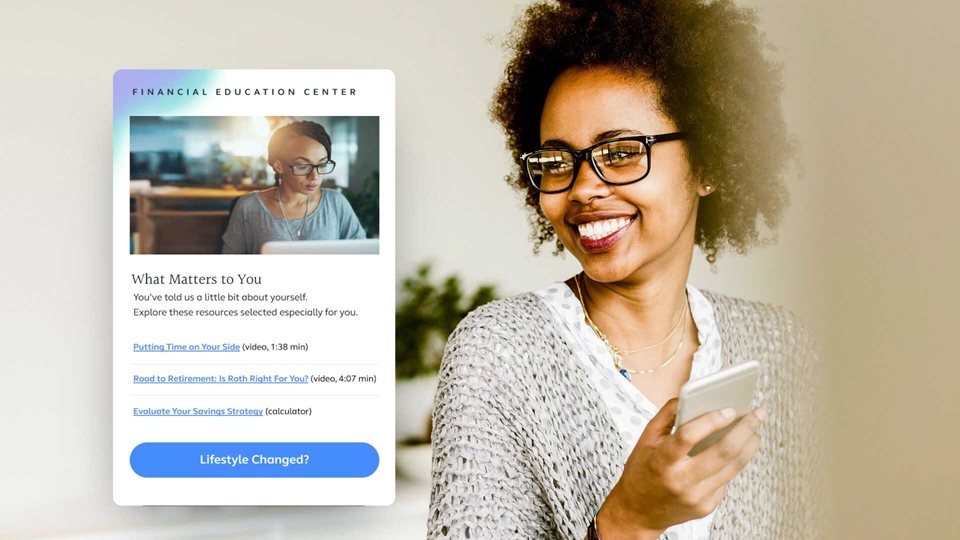

Our financial wellbeing solution offers one-on-one education and planning services from licensed advisors for employees of every age and every financial stage.

Ready to get started?

Learn more about how we can help your business.

Recommended insights

Take a look at our other solutions

Defined Benefit

Pension planning and administration made easy for you and your people.

Financial Wellbeing

Knowledge, tools and advisory support to help people meet their financial goals.