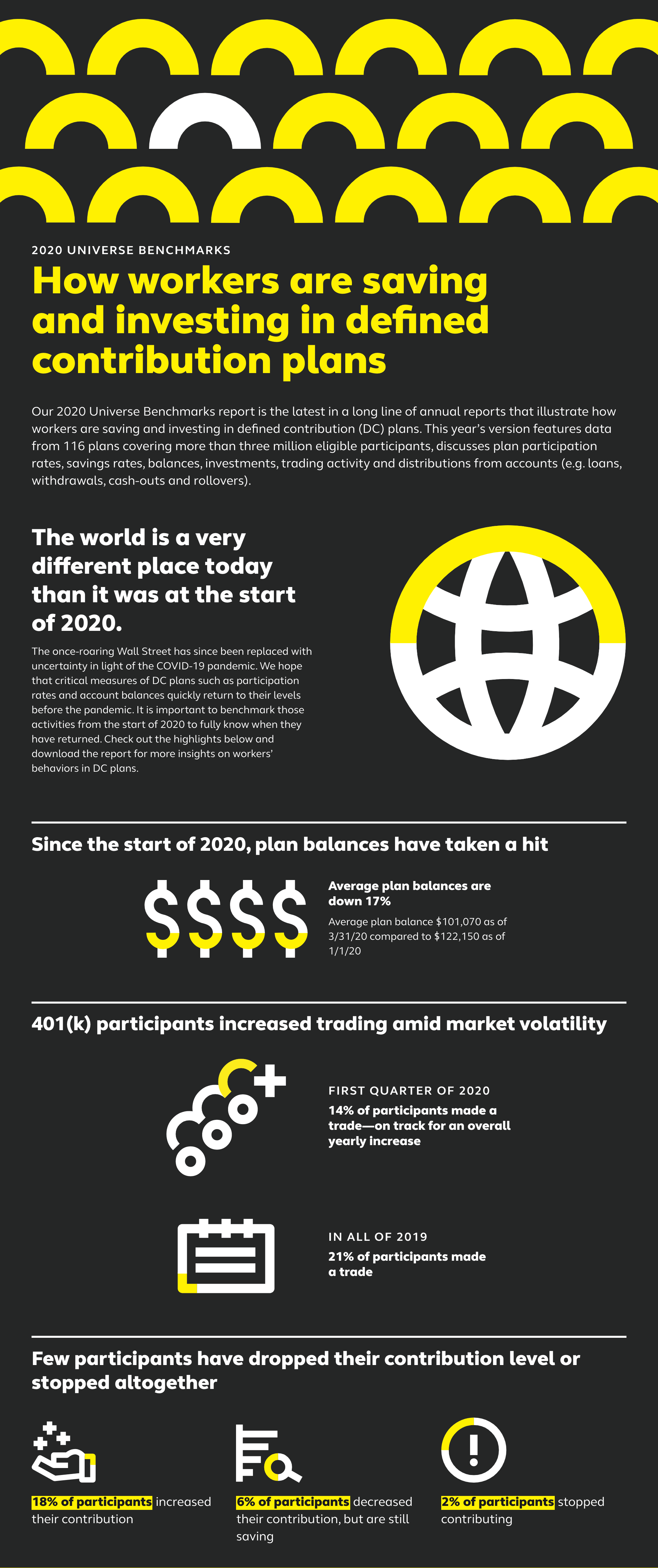

Our 2020 Universe Benchmarks report is the latest in a long line of annual reports that illustrate how workers are saving and investing in defined contribution (DC) plans. This year’s version features data from 116 plans covering more than three million eligible participants, discusses plan participation rates, savings rates, balances, investments, trading activity and distributions from accounts (e.g. loans, withdrawals, cash-outs and rollovers).

Get the full report

If you are interested in a more in-depth analysis of plan data, including deeper cuts by age, gender, tenure and industry, purchase the full report!