Start with more support

Putting money aside for now or what’s to come matters to your people. And your benefits strategy. Our suite of reimbursement accounts supports healthcare, child care, transportation, education costs and more — the things your people want now and your next talent is looking for.

Here’s the Challenge

Premiums keep skyrocketing

Here’s how we solve it

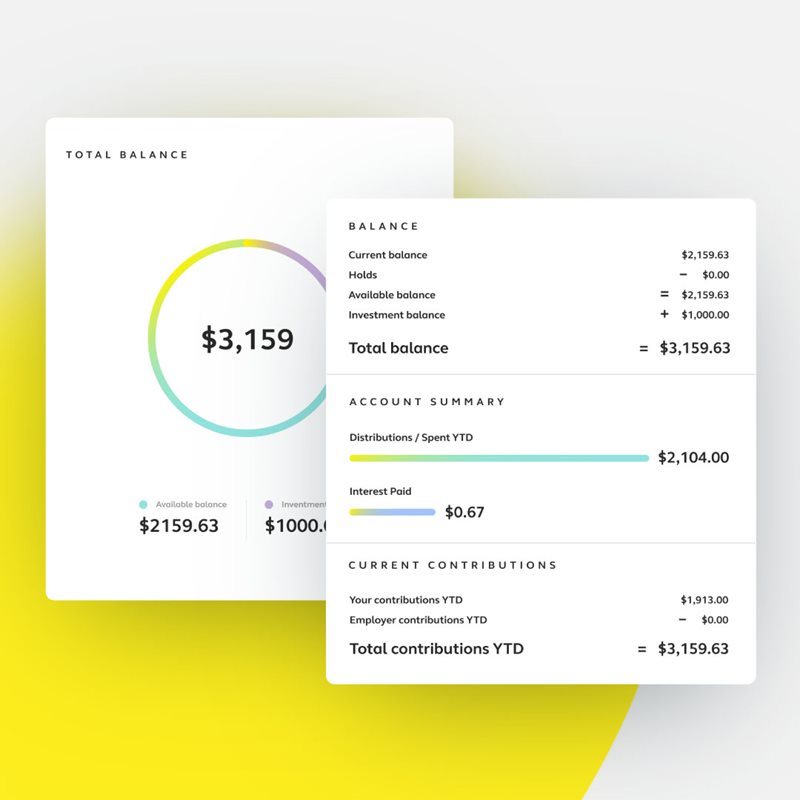

Help people find their balance

Turn spenders into savers

Educational resources communicate the value of an HSA or FSA, so your people know the power behind their reimbursement options.

- Lifestyle accounts

- Health savings accounts

- Flexible spending accounts

- Health reimbursement accounts

- Dependent care accounts

- Adoption assistance

- Commuter benefits plans

- Tuition assistance

Strategize your healthcare spend

Together we find which reimbursement accounts are the right fit, ensuring employee adoption and amplifying your benefits investment.

Employ one platform

Multiple logins, a multitude of vendors – leave it behind. All of your accounts integrate into the Alight platform – enabling a simple user and payment experience for employees and stronger spending insights for you.

More of what's possible with Alight Smart-Choice Accounts®

For employers

Ensure your people have funds to cover important life expenses with an innovative payment solution and benefits platform in one. Leverage insights that improve business decision making and deliver on employee expectations even if healthcare plans change.

Benefits

- Consolidate vendors

- Increase adoption and use of various accounts

- Track spending trends on analytics dashboard

For employees

Give your people help setting aside funds for current and future needs right when they need them. They get access to reimbursement accounts along with enrollment, benefits and customer care all with a single sign on, anytime, anywhere.

Benefits

- One debit card and login for all account details

- Real-time transactions and claims processing

- Free library of resources, calculators

Frequently asked questions

Have a particular question about Reimbursement Accounts? We've answered some of the most commonly asked questions.

What are reimbursement accounts?

Reimbursement accounts allow employees to pay for eligible expenses with pre-tax dollars.

Which expenses qualify for reimbursement?

Common eligible expenses include medical, dental, and vision costs.

How do I submit a claim?

Claims can be submitted through the Alight portal or mobile app.

Are there deadlines for submitting claims?

Yes, deadlines vary by plan. Check your plan details for specific dates.

Can unused funds roll over?

Some accounts allow rollovers, while others follow a use-it-or-lose-it rule.

Customer story

Ready to get started?

Learn more about how we can help your business.

Explore our other solutions

Alight Total Health

A comprehensive health benefits solution with guaranteed ROI.

Benefits Administration

Administer benefits and boost wellbeing at enrollment and throughout the year.

Healthcare Navigation

Guide your people to the right care and savings from the start.

Eligibility & Compliance

Stay on top of regulations and avoidable expenses, even as things change.