A number of industries stand out for their unique approach to employee benefits, including the insurance industry. Here, the quality of benefits are typically higher and employees tend to engage in the programs to a greater degree.

At their core, benefit programs are designed to help a company attract and retain employees. However, there can be wide variability from one industry to the next. This is true both in terms of the types of benefits offered (health insurance, retirement plans, parental leave, life insurance, etc.) and the specific design of what’s made available to the workforce.

Between the millions of participants on our recordkeeping platform and hundreds of companies who have participated in our surveys, we’ve identified 10 ways retirement benefits (and financial wellbeing programs) are different in the insurance industry.

- Most large insurance companies have defined benefit plans, but they are not the primary retirement savings vehicle for the workforce

According to Alight’s 2021 Trends & Experience in Defined Contribution Plans, defined benefit (pension) plans are popular in the insurance industry. However, only one-quarter of insurance companies have an open and ongoing pension plan. The rest are either closed to new participants or frozen for all workers. A defined contribution (DC) plan is now the primary retirement savings vehicle for employees of all insurance companies.

- Automatic enrollment in the 401(k) plan is nearly universal

While automatic enrollment has caught on across industries, it is nearly ubiquitous among insurance companies. As of 2021, 92% of insurance companies default their workers into the DC plan, compared with only about three-quarters of non-insurance companies.

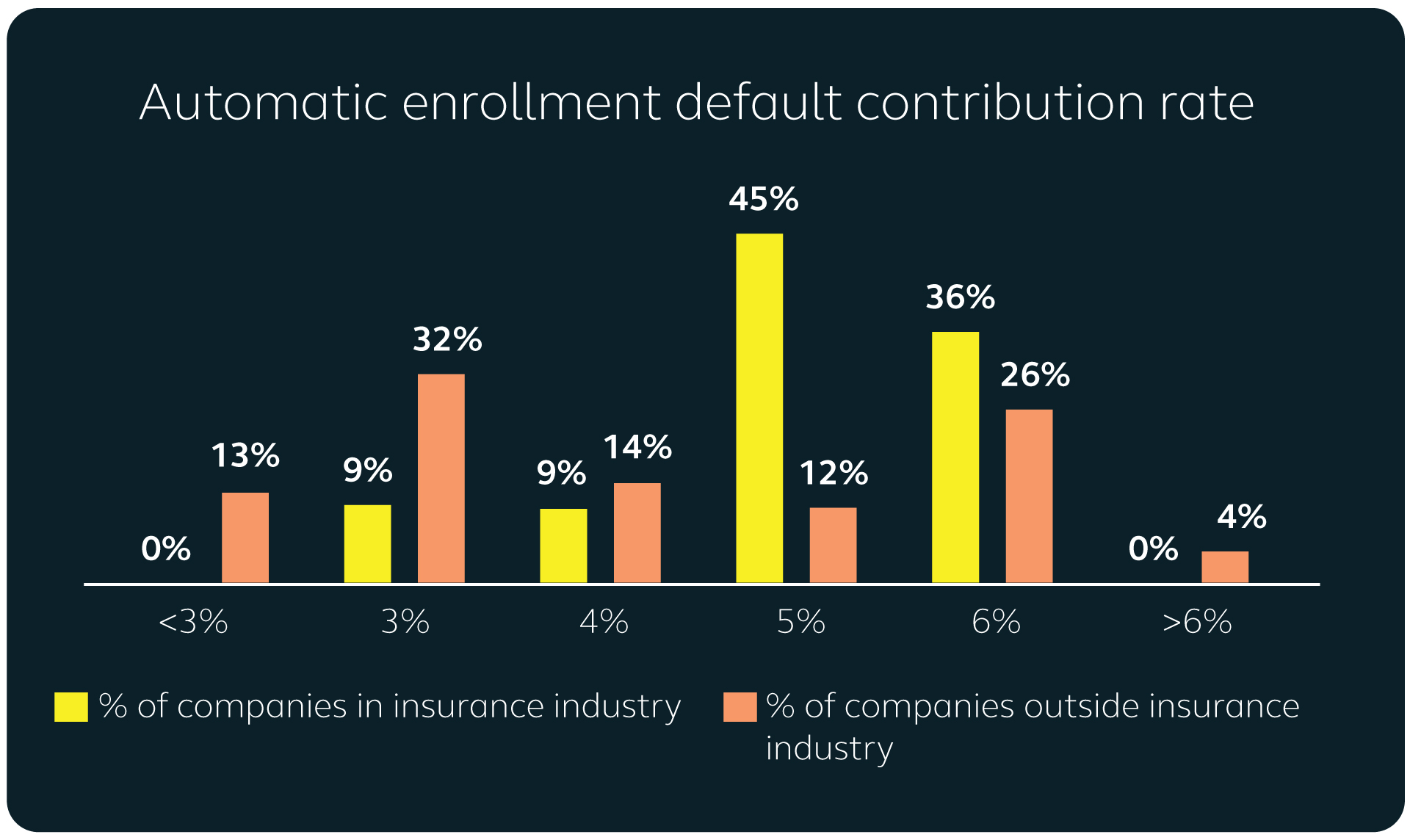

- Default contribution rates for automatic enrollment tend to be higher

On average, the default savings rate for insurance companies tends to be higher: 5.1% compared to 4.2% for non-insurance.

- There is more interest in annuities in DC plans

Given the nature of their business, it should come as no surprise that insurance companies have more interest in adding annuities to their DC plans. Among insurers that don’t have an annuity option in their plan, 91% are very or moderately interested in adding one. By comparison, just 63% of non-insurance companies are interested in doing so.

- It’s less likely that Roth contributions are available

Three-quarters of insurance companies allow workers to save on a Roth basis—considerably lower than the 87% of non-insurance companies who allow for Roth contributions. Interestingly, when Roth contributions are available, a higher percentage of insurance employees (23%) contribute on a Roth basis than other industries (16%), but they tend to contribute less on average (6.3% vs. 6.7%).

- Self-directed brokerage windows are uncommon

Only 20% of insurance companies allow participants to utilize a self-directed brokerage account, compared to about half of plans outside the insurance industry. When insurance companies do offer self-directed brokerage accounts, employee usage is identical to the general population—about 2.5% of participants.

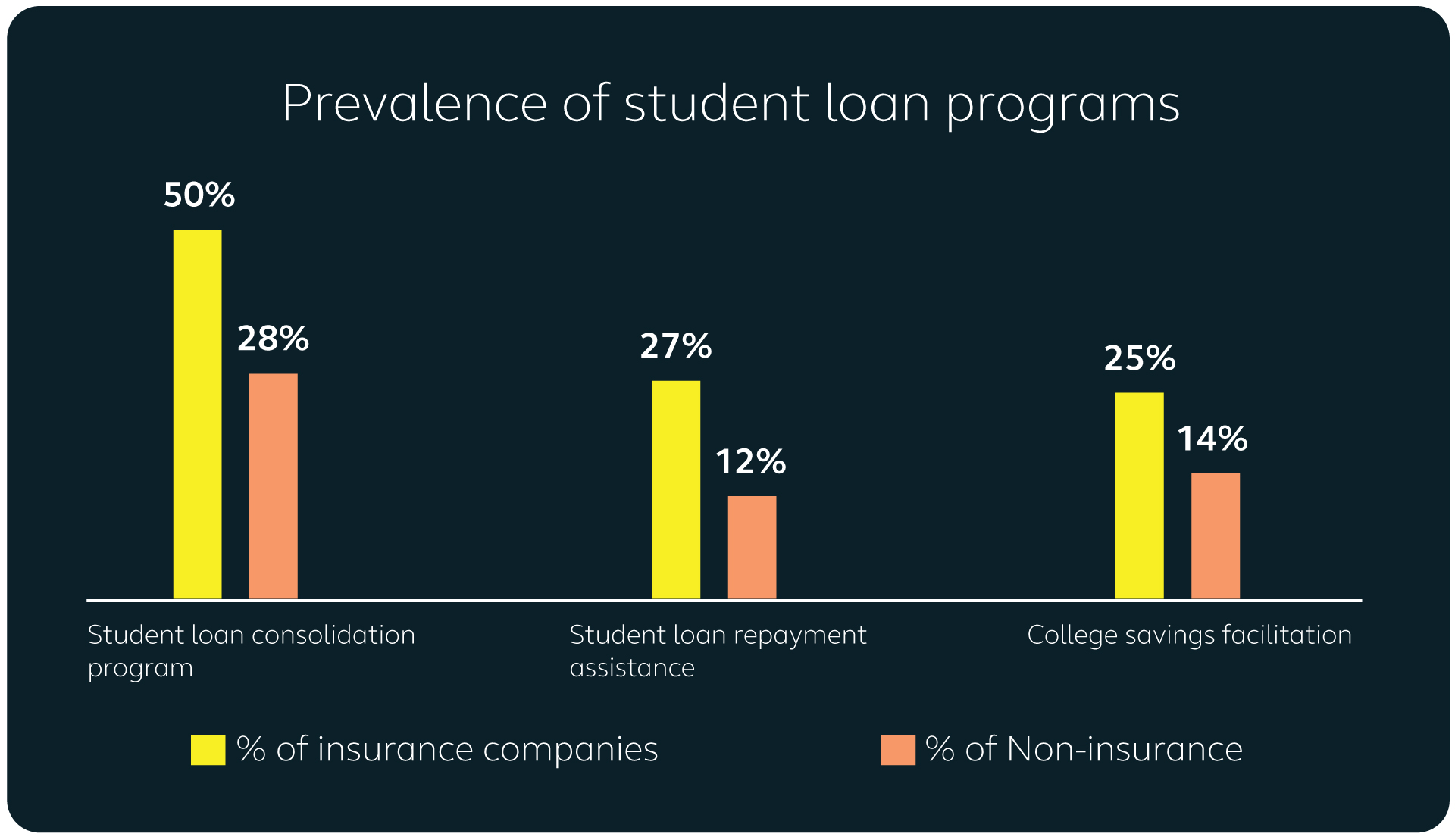

- Insurance companies are ahead of the curve on student loan programs

Student loan assistance is a hot topic for many employers, but insurance companies are more likely than non-insurance companies to offer such programs.

- Three-quarters of insurance workers save above the match threshold

Few insurance participants look to the plan design as an indication of how much to save. Three out of every four participants save at a level above the match threshold, compared to only about half of non-insurance company workers.

- Insurance participants tend to contribute more aggressively than others

On average, insurance participants have almost 80% of their DC plan contributions going to equities—about 10 percentage points higher than the average for non-insurance participants.

- Insurance companies have a heavy focus on financial wellbeing

Three-quarters of employers in the insurance industry say they are very likely to focus on creating and expanding their financial wellbeing programs to extend beyond retirement decisions. Only about half of non-insurance companies say they are very likely to do the same.

Increasingly, companies are recognizing the importance of helping employees achieve their financial goals through a comprehensive retirement and financial wellbeing program. While programs vary from company to company, organizations are better positioned to attract and retain the talent they need when they know what kinds of benefits are being offered by their competitors. For insurance companies, this knowledge will enable them to take a more strategic approach to designing their own benefit offering, which will have an overwhelmingly positive impact on engagement, productivity, and the overall employee experience.